(시계열) apple_stock_exercises

Apple Stock

Introduction:

We are going to use Apple’s stock price.

Step 1. Import the necessary libraries

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

Step 2. Import the dataset from this address

pd.read_csv("https://raw.githubusercontent.com/guipsamora/pandas_exercises/master/09_Time_Series/Apple_Stock/appl_1980_2014.csv")

| Date | Open | High | Low | Close | Volume | Adj Close | |

|---|---|---|---|---|---|---|---|

| 0 | 2014-07-08 | 96.27 | 96.80 | 93.92 | 95.35 | 65130000 | 95.35 |

| 1 | 2014-07-07 | 94.14 | 95.99 | 94.10 | 95.97 | 56305400 | 95.97 |

| 2 | 2014-07-03 | 93.67 | 94.10 | 93.20 | 94.03 | 22891800 | 94.03 |

| 3 | 2014-07-02 | 93.87 | 94.06 | 93.09 | 93.48 | 28420900 | 93.48 |

| 4 | 2014-07-01 | 93.52 | 94.07 | 93.13 | 93.52 | 38170200 | 93.52 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 8460 | 1980-12-18 | 26.63 | 26.75 | 26.63 | 26.63 | 18362400 | 0.41 |

| 8461 | 1980-12-17 | 25.87 | 26.00 | 25.87 | 25.87 | 21610400 | 0.40 |

| 8462 | 1980-12-16 | 25.37 | 25.37 | 25.25 | 25.25 | 26432000 | 0.39 |

| 8463 | 1980-12-15 | 27.38 | 27.38 | 27.25 | 27.25 | 43971200 | 0.42 |

| 8464 | 1980-12-12 | 28.75 | 28.87 | 28.75 | 28.75 | 117258400 | 0.45 |

8465 rows × 7 columns

Step 3. Assign it to a variable apple

apple = pd.read_csv("https://raw.githubusercontent.com/guipsamora/pandas_exercises/master/09_Time_Series/Apple_Stock/appl_1980_2014.csv")

Step 4. Check out the type of the columns

apple.dtypes

Date object

Open float64

High float64

Low float64

Close float64

Volume int64

Adj Close float64

dtype: object

Step 5. Transform the Date column as a datetime type

apple.Date = pd.to_datetime(apple.Date)

apple.dtypes

Date datetime64[ns]

Open float64

High float64

Low float64

Close float64

Volume int64

Adj Close float64

dtype: object

Step 6. Set the date as the index

apple = apple.set_index("Date")

apple

| Open | High | Low | Close | Volume | Adj Close | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2014-07-08 | 96.27 | 96.80 | 93.92 | 95.35 | 65130000 | 95.35 |

| 2014-07-07 | 94.14 | 95.99 | 94.10 | 95.97 | 56305400 | 95.97 |

| 2014-07-03 | 93.67 | 94.10 | 93.20 | 94.03 | 22891800 | 94.03 |

| 2014-07-02 | 93.87 | 94.06 | 93.09 | 93.48 | 28420900 | 93.48 |

| 2014-07-01 | 93.52 | 94.07 | 93.13 | 93.52 | 38170200 | 93.52 |

| ... | ... | ... | ... | ... | ... | ... |

| 1980-12-18 | 26.63 | 26.75 | 26.63 | 26.63 | 18362400 | 0.41 |

| 1980-12-17 | 25.87 | 26.00 | 25.87 | 25.87 | 21610400 | 0.40 |

| 1980-12-16 | 25.37 | 25.37 | 25.25 | 25.25 | 26432000 | 0.39 |

| 1980-12-15 | 27.38 | 27.38 | 27.25 | 27.25 | 43971200 | 0.42 |

| 1980-12-12 | 28.75 | 28.87 | 28.75 | 28.75 | 117258400 | 0.45 |

8465 rows × 6 columns

Step 7. Is there any duplicate dates?

dup = apple[apple.index.duplicated]

if len(dup) != 0:

print("Yes, there are duplicate dates.")

else:

print("No, there are no duplicate dates.")

No, there are no duplicate dates.

Step 8. Ops…it seems the index is from the most recent date. Make the first entry the oldest date.

apple = apple.sort_values(by="Date", ascending=True)

apple

| Open | High | Low | Close | Volume | Adj Close | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 1980-12-12 | 28.75 | 28.87 | 28.75 | 28.75 | 117258400 | 0.45 |

| 1980-12-15 | 27.38 | 27.38 | 27.25 | 27.25 | 43971200 | 0.42 |

| 1980-12-16 | 25.37 | 25.37 | 25.25 | 25.25 | 26432000 | 0.39 |

| 1980-12-17 | 25.87 | 26.00 | 25.87 | 25.87 | 21610400 | 0.40 |

| 1980-12-18 | 26.63 | 26.75 | 26.63 | 26.63 | 18362400 | 0.41 |

| ... | ... | ... | ... | ... | ... | ... |

| 2014-07-01 | 93.52 | 94.07 | 93.13 | 93.52 | 38170200 | 93.52 |

| 2014-07-02 | 93.87 | 94.06 | 93.09 | 93.48 | 28420900 | 93.48 |

| 2014-07-03 | 93.67 | 94.10 | 93.20 | 94.03 | 22891800 | 94.03 |

| 2014-07-07 | 94.14 | 95.99 | 94.10 | 95.97 | 56305400 | 95.97 |

| 2014-07-08 | 96.27 | 96.80 | 93.92 | 95.35 | 65130000 | 95.35 |

8465 rows × 6 columns

Step 9. Get the last business day of each month

apple_month = apple.resample("BM").mean()

apple_month

| Open | High | Low | Close | Volume | Adj Close | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 1980-12-31 | 30.481538 | 30.567692 | 30.443077 | 30.443077 | 2.586252e+07 | 0.473077 |

| 1981-01-30 | 31.754762 | 31.826667 | 31.654762 | 31.654762 | 7.249867e+06 | 0.493810 |

| 1981-02-27 | 26.480000 | 26.572105 | 26.407895 | 26.407895 | 4.231832e+06 | 0.411053 |

| 1981-03-31 | 24.937727 | 25.016818 | 24.836364 | 24.836364 | 7.962691e+06 | 0.387727 |

| 1981-04-30 | 27.286667 | 27.368095 | 27.227143 | 27.227143 | 6.392000e+06 | 0.423333 |

| ... | ... | ... | ... | ... | ... | ... |

| 2014-03-31 | 533.593333 | 536.453810 | 530.070952 | 533.214286 | 5.954403e+07 | 75.750000 |

| 2014-04-30 | 540.081905 | 544.349048 | 536.262381 | 541.074286 | 7.660787e+07 | 76.867143 |

| 2014-05-30 | 601.301905 | 606.372857 | 598.332857 | 603.195714 | 6.828177e+07 | 86.058571 |

| 2014-06-30 | 222.360000 | 224.084286 | 220.735714 | 222.658095 | 5.745506e+07 | 91.885714 |

| 2014-07-31 | 94.294000 | 95.004000 | 93.488000 | 94.470000 | 4.218366e+07 | 94.470000 |

404 rows × 6 columns

Step 10. What is the difference in days between the first day and the oldest

diff = apple.index.max() - apple.index.min()

diff.days

12261

Step 11. How many months in the data we have?

apple_month = apple.resample("BM").mean()

len(apple_month.index)

404

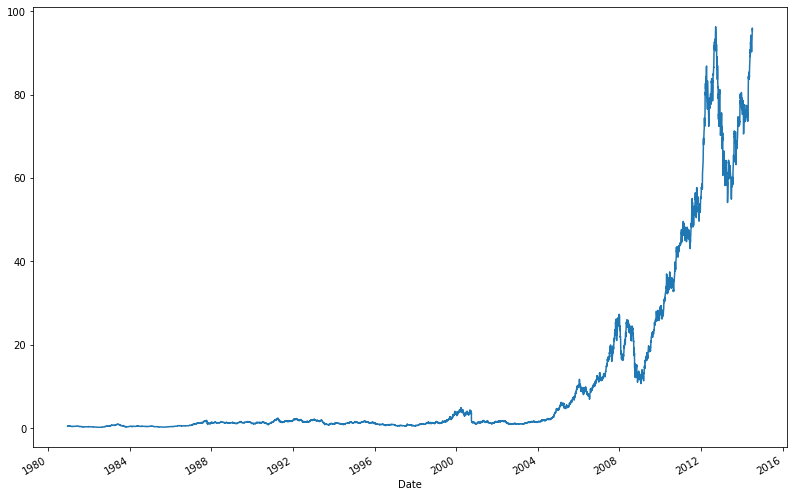

Step 12. Plot the ‘Adj Close’ value. Set the size of the figure to 13.5 x 9 inches

data = apple['Adj Close'].plot()

fig = data.get_figure()

fig.set_size_inches(13.5, 9)

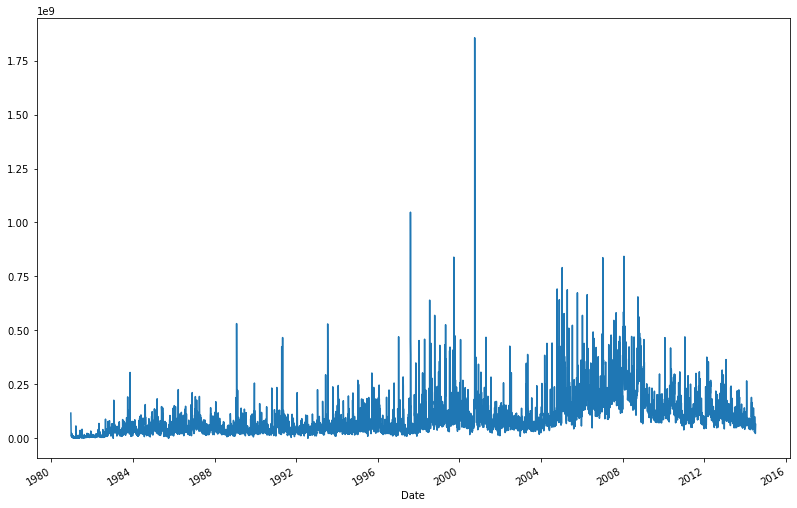

BONUS: Create your own question and answer it.

Plot the total ‘volume’ of Apple Stock being traded each day. Set the size of the figure to 13.5 x 9 inches

data2 = apple['Volume'].plot()

fig = data2.get_figure()

fig.set_size_inches(13.5, 9)

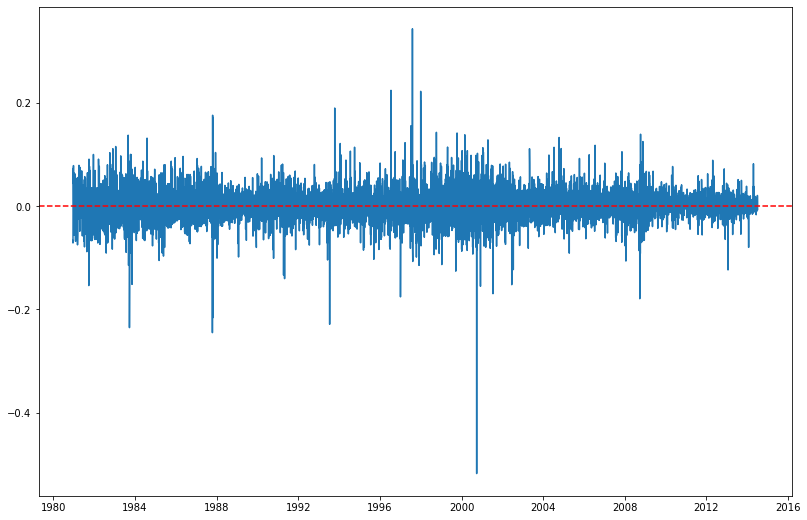

Plot the price-earnings ratio each day. Set the size of the figure to 13.5 x 9 inches

apple['Price_lag_1'] = apple['Adj Close'].shift(-1)

apple['Price_diff_1'] = apple['Price_lag_1'] - apple['Adj Close']

apple['Daily_return'] = apple['Price_diff_1'] / apple['Adj Close']

apple['Updown'] = [1 if apple['Daily_return'].loc[Date] > 0 else 0 for Date in apple.index]

apple_chart = apple[['Adj Close','Price_lag_1','Price_diff_1','Daily_return','Updown']]

apple_chart.head()

| Adj Close | Price_lag_1 | Price_diff_1 | Daily_return | Updown | |

|---|---|---|---|---|---|

| Date | |||||

| 1980-12-12 | 0.45 | 0.42 | -0.03 | -0.066667 | 0 |

| 1980-12-15 | 0.42 | 0.39 | -0.03 | -0.071429 | 0 |

| 1980-12-16 | 0.39 | 0.40 | 0.01 | 0.025641 | 1 |

| 1980-12-17 | 0.40 | 0.41 | 0.01 | 0.025000 | 1 |

| 1980-12-18 | 0.41 | 0.44 | 0.03 | 0.073171 | 1 |

apple['Updown'].value_counts() #주가 상승일(1), 하락일(0)의 수

0 4744

1 3721

Name: Updown, dtype: int64

plt.figure(figsize=(13.5, 9))

plt.plot(apple.index, apple['Daily_return'])

plt.axhline(y=0, color='red', ls='--')

plt.show() #일일 주가 수익률 그래프